Home > News > Industry News > The popularity of the energy storage sector continues to rise, and leading companies in the industry are accelerating their embrace of the capital market.

Recently, the IPO process of a representative enterprise in the energy storage battery management system (BMS) field, Gao Te Electronics, has reached a key milestone - the company will undergo review by the Shenzhen Stock Exchange's listing review committee on January 13, 2026. If approved, this will be a decisive step in its path to listing on

Against the backdrop of the overall rapid growth of the energy storage industry, Gao Te Electronics, leveraging its technological accumulation and market positioning, has achieved steady growth in its performance in recent years, providing a solid financial foundation for this IPO push. Data shows that from 2022 to 2025, the company's revenue has continued to rise, with 2024 revenue reaching 919 million yuan and 2025 revenue at 507 million yuan. The net profit attributable to the parent company also increased from 5.375 million yuan in 2022 to 98.42 million yuan in 2024 (2024), and reached 51.418 million yuan in the first half of 2025, with its profitability continuously strengthening.

It is worth noting that during the period from 2022 to 2024, Gao Te Electronics' main business revenue had a compound growth rate of 63.31%, and the compound growth rate of non-recurring net profit was even 69.79%. This growth rate not only far exceeded that of most manufacturing enterprises but also indirectly confirmed its grasp of the growth opportunities in the rapidly expanding energy storage market.

Behind the high growth in performance is the leading position of the product in key markets and the effective matching of supply and demand structure. During the reporting period, Gao Te Electronics ranked at the forefront of the industry in terms of the shipment volume of large-scale energy storage BMS products. What reflects market confidence is its production capacity and sales data: from 2023 to 2025, the capacity utilization rate remained at a high level, reaching 112.09%, 100.06%, and 131.01% respectively; the sales rate in 2023 and 2024 exceeded 100%, highlighting the strong recognition and urgent demand for the product in the market.

Analysts believe that the energy storage industry is still in the early stage of large-scale development, and BMS, as a key link in ensuring battery safety and improving the efficiency of energy storage systems, has high technical barriers and customer stickiness. Gao Te Electronics' continuous growth in performance in recent years is not only due to industry dividends but also indicates that its products and technologies have entered the supply chain of mainstream customers and possess certain first-mover advantages.

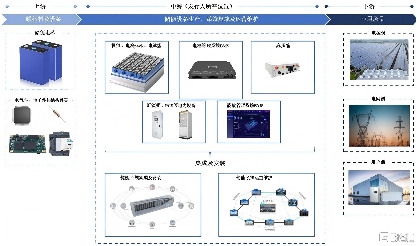

This IPO of Gao Te Electronics aims to raise 850 million yuan, of which 600 million yuan will be invested in the "Intelligent Manufacturing Center Project for Energy Storage Battery Management System". After the implementation of this project, it is expected to significantly enhance the production capacity of core products such as BMS modules and high-voltage boxes, further optimize the production response speed and R&D industrialization capabilities, and provide support for consolidating and expanding market share.

In the current context where the carbon neutrality goal drives the continuous release of energy storage demand, the capital market has always been attentive to high-quality targets in the energy storage industry chain. If Gao Te Electronics can successfully list, it will not only inject capital momentum into its own development but also, through the public company platform, deepen technology layout and business expansion, especially in areas such as data services and system integration, to conduct more in-depth exploration.